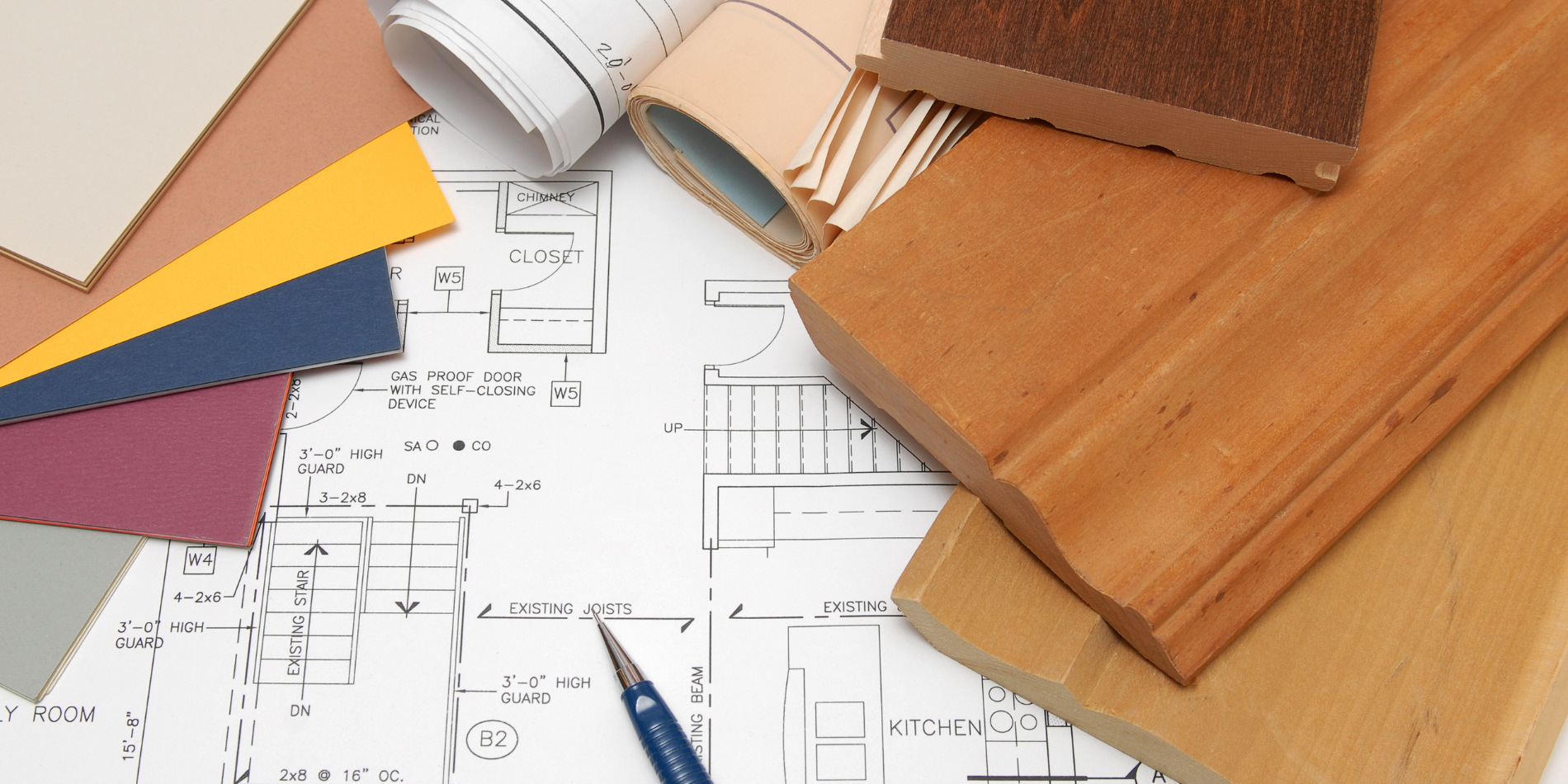

Architects are experts at designing spaces that function beautifully—but behind the scenes, the financial framework isn’t always as refined. With complex billing cycles, multiple stakeholders, and long project timelines, architectural firms face unique bookkeeping hurdles.

Here are 10 common challenges architectural businesses face—plus smart, scalable solutions to streamline operations and build a more profitable practice.

1. Tracking Costs by Phase or Project

The challenge: Architectural projects span months (or years) and involve distinct phases—conceptual design, schematics, CDs, CA, etc. Without detailed job costing, it’s hard to know where time and money are going.

The solution:

Use Xero Projects, QuickBooks with class/location tracking, or a more specialized tool like Monograph or BQE Core to assign costs and billable time to specific project phases. This gives you clear insight into profitability by stage—not just per client.

2. Progress Billing and Invoicing

The challenge: Architects often invoice based on milestones or percent-complete. But if your invoicing system isn’t synced with your contract terms, billing becomes inconsistent and cash flow suffers.

The solution:

Set up progress billing templates in your accounting software that reflect your AIA contract structure. Use platforms like FreshBooks, BQE Core, or Xero to automate recurring invoice stages tied to project completion or calendar milestones.

3. Tracking Retainers and Prepaid Hours

The challenge: Many firms collect retainers or bill upfront hours—but those funds shouldn’t be treated as revenue until earned. Misclassifying these creates tax and cash flow issues.

The solution:

Record retainers as liabilities on your balance sheet. As services are rendered, apply the appropriate portion to income. This also ensures you don’t accidentally spend unearned funds too soon.

4. Managing Subcontractors and Consultants

The challenge: You may hire outside engineers, renderers, or surveyors for part of a project. If their costs aren’t tracked and allocated properly, you risk undercharging the client or eroding your margins.

The solution:

Use purchase orders and cost coding to assign each consultant’s invoice to the correct job and phase. If consultants are billed to the client, flag them as reimbursable expenses and ensure you’re marking up appropriately.

5. Time Tracking Across the Team

The challenge: Billing hourly work or managing labor against project budgets is hard without accurate time tracking—and that means over-servicing becomes easy to overlook.

The solution:

Equip your team with a tool like Harvest, Toggl, or BQE Core. These integrate with most accounting platforms and let you analyze hours logged vs. budgeted per project phase. Weekly reporting keeps scope creep in check.

6. Sales Tax on Services vs. Deliverables

The challenge: In some states, architectural design is taxable; in others, only physical deliverables (like printed plans) are. Misunderstanding this can trigger tax penalties.

The solution:

Consult your state’s tax guidelines or use a tool like Avalara or TaxJar to automate tax calculations based on the service and location. Keep digital records of all tax-exempt sales or resale certificates.

7. Overhead Allocation

The challenge: Without a clear way to allocate overhead (software, rent, admin time) to active projects, your reports might show a misleading profit picture.

The solution:

Use burdened labor rates when planning project budgets—i.e., include indirect costs in each team member’s hourly rate. Alternatively, allocate overhead proportionally across projects based on revenue or hours.

8. Cash Flow Planning for Long Projects

The challenge: Projects can span 12–24 months, but expenses like payroll, rent, and software subscriptions are ongoing. Without proactive cash flow planning, your firm may feel the pinch mid-project.

The solution:

Use cash flow forecasting tools like Float, Fathom, or your accounting software’s built-in planner to map out monthly needs. Always keep 2–3 months of operating expenses in reserve and bill clients in phases to support steady cash inflow.

9. Reconciling Design Tools with Accounting

The challenge: Tools like Monograph, Asana, or Trello help manage workflows—but they don’t always sync with your accounting platform, leading to double entry or misaligned data.

The solution:

Look for platforms like BQE Core or Monograph that combine project management and accounting in one, or use integration tools like Zapier or Make (Integromat) to link your systems together.

10. Lack of Real-Time Financial Insights

The challenge: Without current reports, it’s hard to answer key questions: Are we making money on this job? Is our utilization rate improving? Can we afford to hire?

The solution:

Set up a monthly dashboard that tracks KPIs like project margin, WIP (Work In Progress), utilization, and AR aging. A knowledgeable bookkeeper or outsourced CFO can help you interpret the data—and make decisions grounded in facts, not guesswork.

Final Blueprint

Architects design with precision—and your financials deserve the same level of care. Whether you’re solo or managing a full studio, clean books and solid systems help you quote smarter, scale sustainably, and grow with confidence.

Need help building a financial foundation as strong as your next design?

Let’s talk about how Creative Balance Bookkeeping supports architectural firms just like yours.