What Is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization.

Put simply, it shows how profitable your firm is from a core operational standpoint, before accounting for financing choices or depreciation on long-term assets.

Think of it as a high-level snapshot of how well your business runs day to day—how efficiently you turn project work into profit, without factoring in accounting rules or outside financial pressures.

What Is Net Income?

Net income, on the other hand, is the bottom-line number—your actual profit after subtracting every single expense: wages, taxes, software, insurance, loan interest, and depreciation on things like equipment, vehicles, or your office leasehold improvements.

It’s the number that typically shows up on your tax return and is used to measure the true financial outcome of your business decisions.

Let’s Look at Industry-Specific Examples

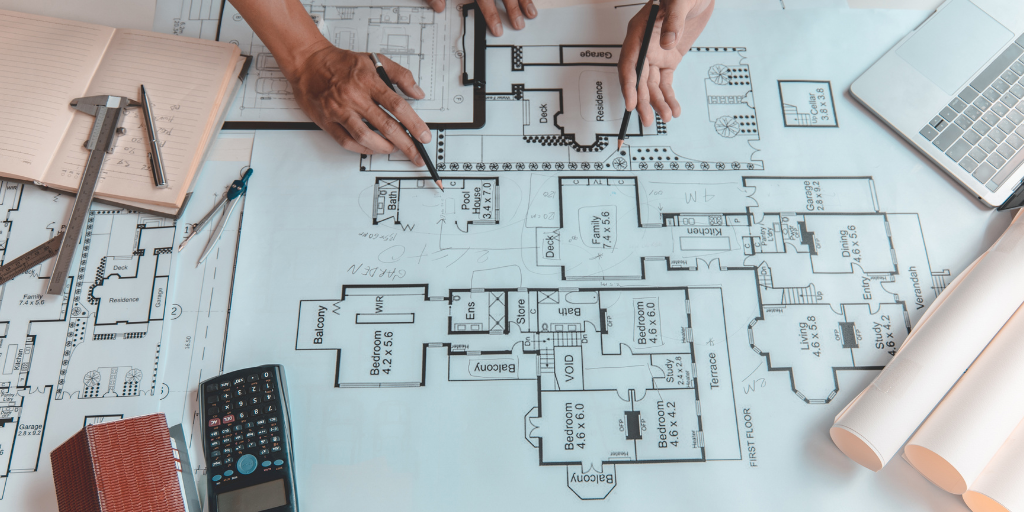

🏗️ Civil or Mechanical Engineer:

Your EBITDA would reflect income from contracts minus operating costs like employee wages, drafting software, travel reimbursements, and subcontractor fees.

Net income would subtract the interest from equipment loans and depreciation on field tools, CAD workstations, or company vehicles.

🏛️ Architect or Landscape Architect:

EBITDA includes income from design projects minus expenses like office rent, admin staff, and printing plan sets.

Net income includes your depreciation on expensive plotters or 3D modeling equipment—and that auto lease you use for site visits. Plus, any loan interest or tax obligations tied to business debt or equipment purchases.

🛋️ Interior Designer:

EBITDA covers client income after subtracting your day-to-day costs like design assistant hours, material samples, subscriptions (like Ivy or Houzz Pro), and studio rent.

Net income includes loan interest on your studio renovation or depreciation on furniture you purchased for client staging—expenses that don’t show up in EBITDA.

Why Do These Numbers Matter?

-

EBITDA helps you understand how well your firm is performing before financial and accounting decisions come into play. It’s great for benchmarking operations or evaluating internal efficiency.

-

Net income is your true bottom line. It’s essential for making decisions about taxes, distributions, reinvestment, or whether it’s time to hire or outsource.

Both numbers matter—but they serve different purposes.

Not Sure Which to Use?

If you’re not sure which number to focus on—or how to use them to make smarter business decisions—we can help.

At Creative Balance Bookkeeping, we work with design-forward firms and service professionals just like you to simplify the numbers, streamline your reports, and build a system that supports sustainable growth.

💬 Ready to stop guessing and start leading with clarity?

Let’s talk!